The Ultimate Guide To Fortitude Financial Group

The Ultimate Guide To Fortitude Financial Group

Blog Article

The 5-Minute Rule for Fortitude Financial Group

Table of ContentsFortitude Financial Group for DummiesEverything about Fortitude Financial GroupFortitude Financial Group Can Be Fun For EveryoneGetting The Fortitude Financial Group To Work

With the appropriate plan in area, your money can go additionally to assist the organizations whose objectives are lined up with your worths. A monetary consultant can assist you define your charitable offering objectives and incorporate them into your monetary strategy. They can likewise suggest you in appropriate ways to maximize your giving and tax obligation reductions.If your service is a partnership, you will wish to experience the sequence planning process with each other - St. Petersburg, FL, Financial Advising Service. An economic advisor can assist you and your partners comprehend the vital elements in business succession planning, identify the worth of business, produce shareholder arrangements, establish a settlement structure for successors, overview shift choices, and much more

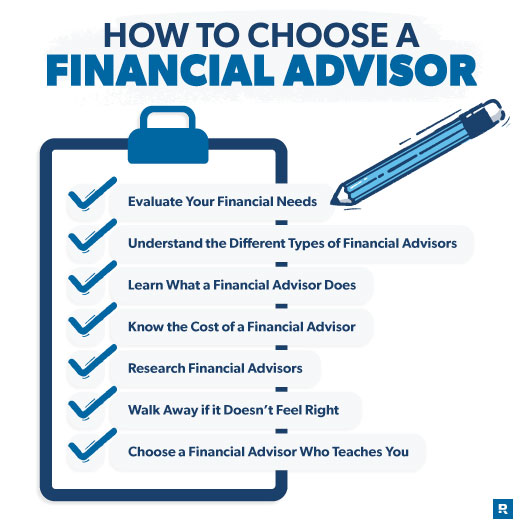

The secret is finding the ideal monetary consultant for your situation; you might finish up interesting different advisors at various stages of your life. Try calling your economic establishment for referrals.

Your next step is to talk to a certified, accredited expert who can offer guidance tailored to your private circumstances. Nothing in this post, neither in any kind of connected sources, must be interpreted as financial or legal recommendations. While we have made great belief initiatives to make certain that the information presented was right as of the day the material was prepared, we are incapable to guarantee that it stays precise today.

About Fortitude Financial Group

Financial consultants assist you choose about what to do with your cash. They lead their customers on saving for major purchases, placing cash aside for retired life, and investing cash for the future. They can also suggest on present economic and market task. Allow's take a more detailed look at exactly what a monetary consultant does.

Advisors use their understanding and expertise to build personalized monetary plans that intend to accomplish the financial objectives of customers (https://www.metal-archives.com/users/fortitudefg1). These strategies include not just investments yet likewise savings, budget plan, insurance, and tax obligation methods. Advisors further examine in with their clients often to re-evaluate their present situation and strategy accordingly

Unknown Facts About Fortitude Financial Group

To accomplish your objectives, you might require a knowledgeable specialist with the ideal licenses to assist make these plans a reality; this is where a financial expert comes in. With each other, you and your consultant will cover many subjects, consisting of the amount of cash you must save, the types of accounts you require, the kinds of insurance coverage you ought to have (including lasting treatment, term life, disability, and so on), and estate and tax obligation planning.

Financial experts give a selection of services to clients, whether that's giving reliable basic financial investment recommendations or helping within a financial goal like spending in an university education fund. Below, find a checklist of one of the most typical services given by economic advisors.: A monetary advisor offers suggestions on financial investments that fit your style, goals, and threat resistance, developing and adjusting spending technique as needed.: A financial expert produces methods to help you pay your debt and stay clear of financial obligation in the future.: A financial expert offers tips and techniques to develop budgets that assist you satisfy your goals in the short and the lengthy term.: Part of a budgeting strategy might include approaches that aid you pay for higher education.: Similarly, an economic advisor develops a saving plan crafted to your particular needs as you head right into retirement. https://slides.com/fortitudefg1.: An economic advisor assists you identify individuals or organizations you wish to obtain your heritage after you die and creates a strategy to perform your wishes.: An economic expert offers you with the very best lasting remedies and insurance policy alternatives that fit your budget.: When it comes to taxes, a financial expert might assist you prepare tax returns, maximize tax obligation deductions so you obtain one of the most out of the system, routine tax-loss gathering safety sales, make sure the finest use of the capital gains tax obligation rates, or plan to reduce tax obligations in retired life

On the questionnaire, you will certainly additionally show future pensions and earnings resources, job retired life needs, and describe any long-lasting monetary responsibilities. In other words, you'll detail all present and expected investments, pensions, presents, and income sources. The investing element of the questionnaire touches upon even more subjective subjects, such as your threat resistance and danger ability.

Excitement About Fortitude Financial Group

At this factor, you'll likewise let your expert understand your investment choices. The preliminary assessment might likewise include an examination of various other monetary administration subjects, such as insurance concerns and your tax obligation situation. The advisor requires to be conscious of your existing estate strategy, in addition to various other experts on your planning team, such as accountants and lawyers.

Report this page